Bitcoin has its impact on multiple fields around the world, even Elon Musk confirmed that you can buy now a Tesla with Bitcoin. It simplifies the purchase process by avoiding the bank transfer procedures (especially in international deals), connecting buyer and seller in real-time and speeding up the process, even if you’re buying from another part of the world.

Now that cryptocurrencies are becoming more common (with ongoing value growth), the ability to buy real estate with bitcoin has now become a possibility.

What is Bitcoin?

Bitcoin (₿, BTC) is a digital, global currency – no cards, no cash and no bank transfers. The mathematical field of cryptography is the basis for Bitcoin’s security.

Each Bitcoin is a file that can be stored in your ‘digital wallet’ app or your laptop. People can transferBitcoins to your digital wallet (with the current price even parts of a Bitcoin are quite valuable), and you can send Bitcoins to other people. Each transaction is recorded in a shared public ledger that supports the network, called the blockchain.

In general you don’t need any technical skills in order to use Bitcoin. To get started using it, you need to set up a Bitcoin wallet on your mobile phone or computer. An id will be assigned to you, which is used as an account to send or receive money. When you send or receive the currency, your Bitcoin wallet keeps a private key which serves as validation that you own the wallet (very similar to digital signatures, they both use crypto technology).

In which countries you can use Bitcoin

European Union

On Oct. 22, 2015, the European Court of Justice (ECJ) ruled that buying and selling digital currencies is considered a supply of services and that this is exempt from value-added tax (VAT) in all European Union (EU) member states. Additionally, some individual EU countries are further developing their own Bitcoin stances.

We can name a few countries that allow using Bitcoin and regulate it like the United States, Canada, Australia, France and Finland and the list is growing!

Swiss crypto laws are quite positive as well, but still regulated. According to the Switzerland regulator, FINMA, you’re allowed to transfer the assets to other wallets whose owners are identified and verified. Exchanges must carry out enhanced due diligence with respect to anti-money laundering and combatting the financing of terrorism.

Portugal is also considered a Bitcoin user-friendly country. The government is confirming that Bitcoin is like any other currency you can use for transactions. Portugal is already recognized as a technology driven country and IT hub for people from all over the world and using Bitcoin in Portugal is tax free for individuals, however it’s subject to capital gain tax for companies selling it (between 28% and 35%.)

Bitcoin advantages when buying property

Bitcoin just entered real estate markets, and not every real estate agent is ready. It may be time to start to think about it, and learn about the benefit of using it in your real estate transactions. We’ll show you the way. So, what are the advantages?

1. Creates a new transaction platform to transfer money

The blockchain enables transactions with online marketplaces or trading platforms by acting as a process that permits asset trading. Sweden’s land registry authority has been testing ways to record property transactions using this technology, which could theoretically save over €100 million each year by eliminating paperwork and resulting in speedy transactions. There is no need for many of the additional fees or intermediaries that can be involved in fiat currency real estate deals, so BTC transactions are quite streamlined by comparison. BTC can accommodate purchases of properties at any price.

2. Prevents fraud

Bitcoin’s private, fully certifiable digital identification allow you to safely transfer and receive money from deal participants. This shows a reliable proof of funds, even more so than a bank letter. You can use this digital ID for your property transaction, future mortgage payments, escrow or other financial scenarios.

3. Encourages investment

Bitcoin is an investment itself; many people have already benefited from it. Rather than saving cash money or bank funds for property purchase, investors can buy and sell parts of their real estate tokens instead. In this way, real estate is looking more like a stock market.

4. Improves transparency

Buyers and sellers store their information securely, but cryptocurrency is instantly verifiable without additional services and processes. Transaction details are visible to all parties. This saves you money without making you hire attorneys, lawyers etc for the same services as traditional transactions. Of course, you might need professional services for the deed and papers, but less professional service hours will be spent.

As long as due diligence is performed, there is no reason that real estate bitcoin payment cannot offer a smooth, rapid and convenient option to buyers and sellers. If you are considering purchasing real estate with bitcoin, you will be among the early adopters of cryptocurrency.

Has anyone used Bitcoin for property transactions?

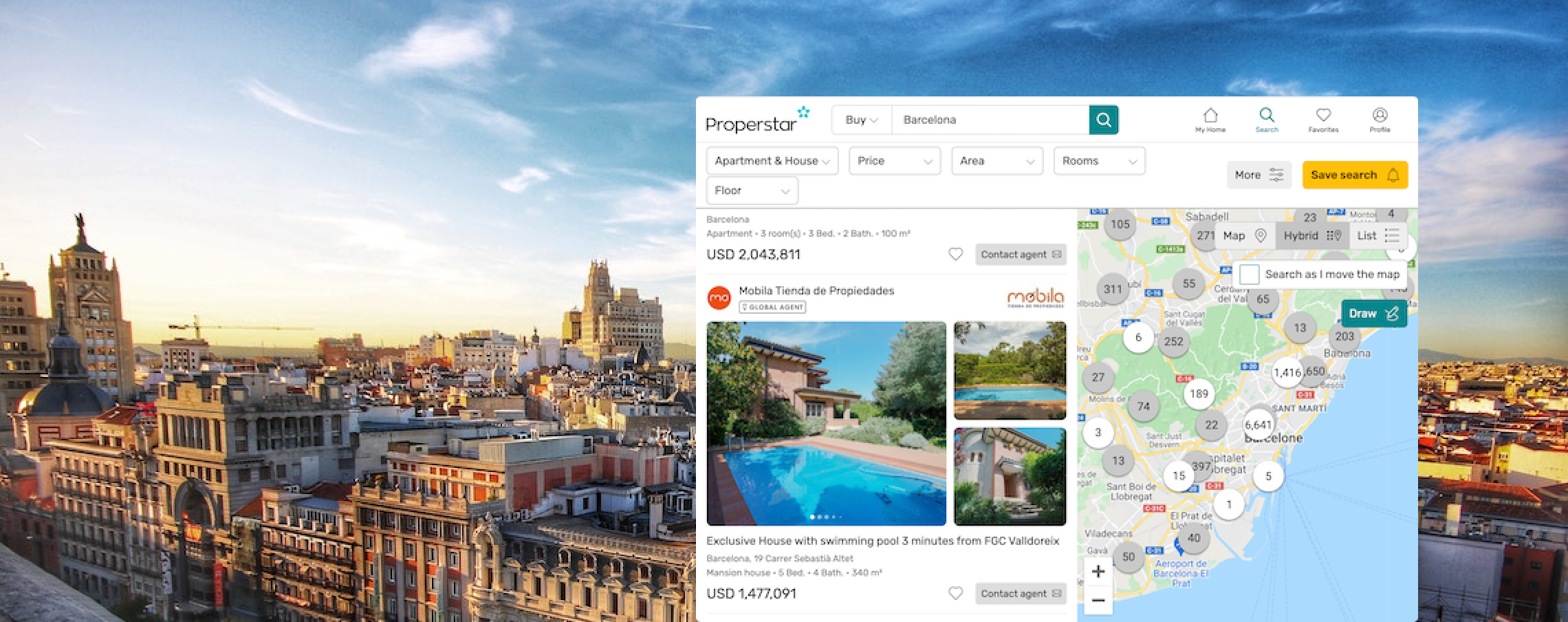

And our answer is yes! One of Listglobally clients (Properstar is a member of Listglobally family), Elliot Bogod, has experienced the sale of property using cryptocurrency and shares some insights about his experience with us.

Mr. Bogod points out the following thoughts:

- alternative assets like Bitcoin and gold are priced against the dollar

- the U.S. dollar is starting to weaken against the Euro and the British pound

- Visa card will allow payment statements using cryptocurrency soon and Tesla acceptst payments in Bitcoin

Paypal reported 11.8% revenue increase in Nov. 2020 after enabling crypto purchases. And since Bitcoin is growing right now, you might get your real estate asset at a benefit without spending time and money to selling it and transferring funds to the seller.

Finally, how hard is it to buy real estate with Bitcoin?

In the United States, the IRS has classified bitcoin as a form of real property. So, in a unique way, real estate bitcoin transactions accommodate a separate layer of capital investment, (in addition to the real, physical properties that are being bought and sold.)

Because BTC’s value in fiat currency does fluctuate (we could observe it early this year), real estate transactions in BTC rely upon mutual agreements between buyer and seller on fiat currency sales prices. There is a certain risk for a buyer, when the Bitcoin rate is falling as it might take some time between signing the agreement and the date when you transfer the funds, but it can work in the other direction as well.

We asked Mr. Bogod if he had clients who used Bitcoin to invest in real estate. “We’ve had many clients who are interested in using their Bitcoin to purchase real estate properties in New York. However, when it comes time to execute the transaction, many are looking to take advantage of low mortgage rates and converting to dollars. When it comes to down payments, sellers would like to see that contract is secured and most buyers are converting their cryptocurrency and putting down payment in dollars. Sellers have mortgages (and other banking), that are conducted with fiat currency.”

What to expect?

Bitcoin has, so far, the most popular cryptocurrency. The trend is expected to continue to grow as the price of bitcoin increases and the ability to either purchase directly with bitcoin or exchange the currency becomes common practice. Many investors look at the platform as an opportunity to turn their bitcoin investment into a tangible asset in real property.